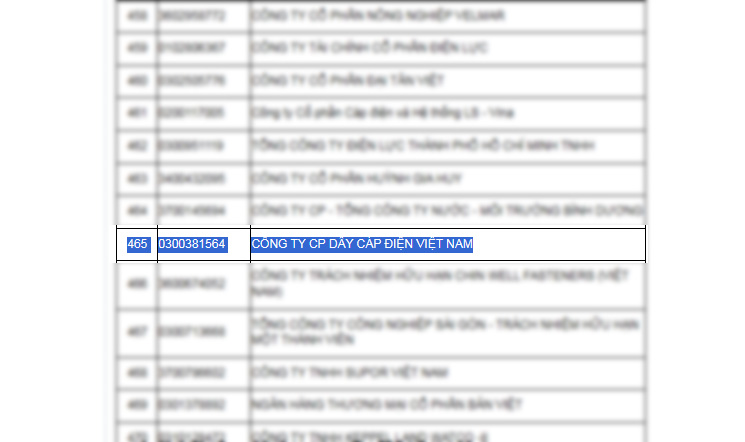

CADIVI is listed among the top 1,000 largest corporate income taxpayers (V1000) in 2022

- 10:12, 25/10/2023

- 2125

The businesses selected for inclusion in the V1000 ranking list for the year 2022 comprise domestic companies established under Vietnamese law, foreign enterprises, and other organizations engaged in production and business activities subject to corporate income tax (CIT) as stipulated by the Corporate Income Tax Law.

The corporate income tax (CIT) amount is the total CIT that a business has paid to the state budget in 2022. Businesses with branches or dependent units (each assigned a 13-digit tax code) should include the CIT paid by their main headquarters and all branches and dependent units.

In accordance with Directive No. 26/CT-TTg dated June 6, 2017, by the Prime Minister regarding the continued effective implementation of Government Resolution No. 35/NQ-CP dated May 16, 2016, on supporting and developing businesses until 2020, the Ministry of Finance has been tasked with: "Directing tax authorities to publicly disclose the detailed ranking list of the top 1,000 enterprises with the largest corporate income tax payments in Vietnam on the electronic information portal." Therefore, each year, the General Department of Taxation compiles the list of the top 1,000 enterprises based on tax payment data in the tax management information system.

In addition to this, in October, CADIVI was also honored in the Top 25 ranking of company brands in the field of personal and industrial consumer goods in Vietnam in 2023, as announced by Forbes Vietnam. In this ranking, CADIVI achieved a high position in the Top 25 alongside GELEX Group and other affiliated units, making a significant contribution to the energy sector in Vietnam.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/nickel-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/aluminum-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/lead-d.gif)